By Lewis Krauskopf

(Reuters) – A look at the day ahead in Asian markets.

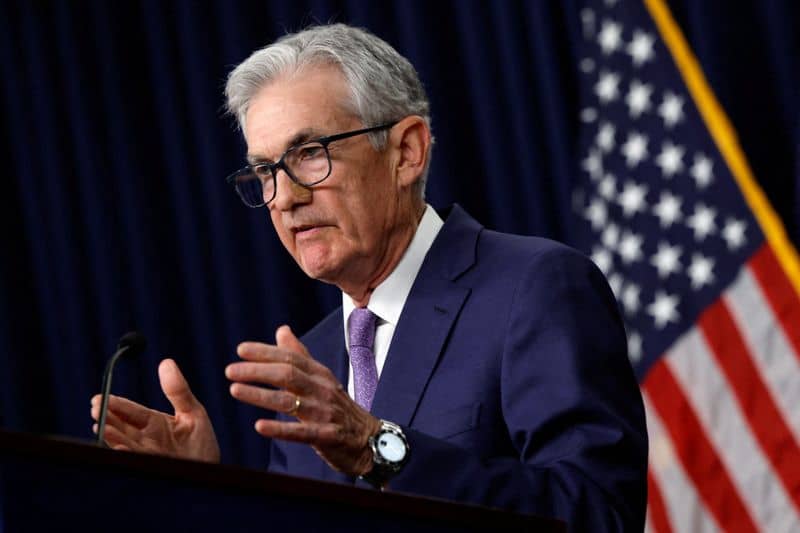

The global markets spotlight moves from Paris to Capitol Hill on Tuesday as Federal Reserve Chair Jerome Powell testifies before the U.S. Congress and a busy week of events revs up.

Politics were front and center on Monday as investors digested the surprise election in France that saw the leftist New Popular Front alliance unexpectedly coming first. French stocks gave up early gains to drop 0.6% as investors mulled chances of a hung parliament, while the pan-European index ended little changed.

The euro waffled against the dollar, at one point touching a multi-week high against the greenback before moving lower.

U.S. politics were also a hot topic, with President Joe Biden under pressure to drop out of the presidential race after his shaky debate performance. Biden refused to abandon his reelection campaign on Monday, but investors were preparing to game out scenarios if another Democratic candidate emerges.

Despite the political turmoil, the benchmark U.S. stock index and MSCI’s all-country index both logged record highs on Monday.

hit a record intraday high on Monday before closing down 0.3%.

Meanwhile, mainland China and Hong Kong stocks ended lower on Monday, with the blue-chip CSI300 index dropping 0.85% for its fifth-straight session of losses.

Powell stands as the next test for assets. The Fed chief is set to deliver his semi-annual monetary policy testimony before the banking committee of the U.S. Senate. He will also be grilled by the other chamber of Congress the next day, appearing before a House of Representatives panel.

Investors have been solidifying their view for the Fed to start rate cuts in September, with roughly 75% odds of a cut at that meeting, according to Fed Funds futures pricing.

Will Powell give any hints? In Portugal last week, the Fed chair said the central bank still needs more data to ensure inflation has moderated sufficiently. Thursday’s consumer price index report will provide the next evidence on the path of inflation.

Here are key developments that could provide more direction to markets on Tuesday:

– Taiwan import/export (June)

– Australia business confidence (June)

– Fed Chair Powell testifies at Senate committee